One veteran banker has likened Government domestic debt restructuring plan to that of “an axe in the heart of banks”, while giving a strong indication that commercial banks will no longer be willing to take on Government debt, other than what they are mandated to by law.

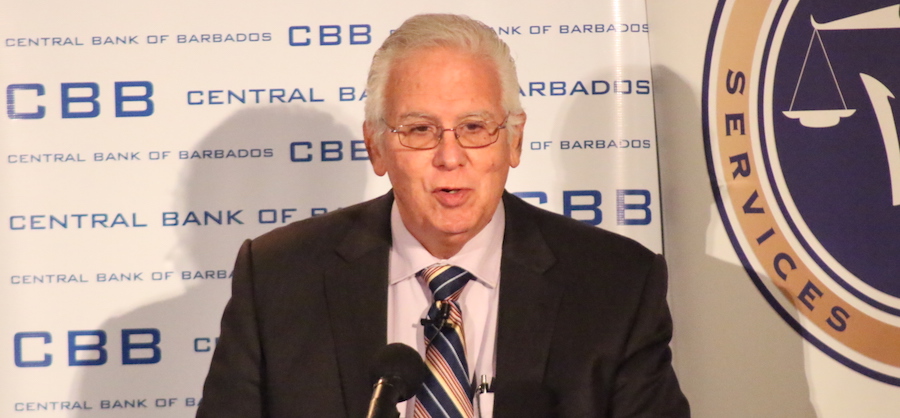

Chairman of Republic Financial Holdings Limited Ronald Harford suggested that banks would be even more skeptical about investing in Government paper, following the deal reached with them last year.

He was speaking while taking part in a panel discussion at the 10th Domestic Financial Institutions Conference at the Central Bank on Thursday under the theme Repositioning Barbados’ Financial Sector.

“Banks have to revisit their thinking about lending to Government. I think the goal that the Government has, of having a debt to GDP of 60 per cent is going to visit them [banks] in their needs to access capital from today . . . [and] the banks are going to take a view that if they are going to lend to Government the debt to GDP must not exceed 60 per cent,” said Harford.

“So the vast majority of the islands will not be able to access capital from the banking system, they will have to go to the CDB [Caribbean Development Bank], IMF [and others] to finance their debt, and that is a lesson that came home very clearly and has sunk into the psyche of the banks in the region,” he said, as he pointed out that the banks lost heavily on a number of Government securities in the region.

In its 2018 annual report published last December, Republic Financial said that increased provisions resulting from the impact of the Government default and subsequent restructuring of its debt had resulted in a $22 million decrease in the profit of its Barbados operation after tax.

As at September 30, 2018, the bank’s commercial banking subsidiary had made a total provision of TT$727 million for its exposure to the Barbados Government.

“When in negotiating the restructuring of the debt, the Barbados Government could say to the banks if you lend to a country whose debt to GDP exceeds 140 per cent, you can’t be serious about getting back all of your money, that was like an axe that went into the heart of the banks. We will need to be [wiser] about how we go forward, it is a very strong and brutal lesson that we have learned,” said Harford.

As at December 2017, commercial banks were required by law to hold 20 per cent of their deposits in stipulated Government securities and at September last year, commercial banks had a total of $180.7 million in Government debt.

Back in September, Government had announced that it had reached a debt restructuring deal for domestic holders of Government debt, while promising that a similar deal for external creditors would be announced in the not-too-distant future.

Under that deal, which was finalized for domestic debt holders in last October, the majority of loans were swapped for new debt instruments, with lower interest rates and a longer period over which they would be repaid.

However, external creditors have been adamant that they were not prepared to take a similar deal, while presenting Government with their own proposal.

Economist Dr DeLisle Worrell, who is an advisor to a group of external creditors, had revealed last December that “a proposal, which meets the Central Bank’s foreign reserves needs, and at the same time, is acceptable to the holders of US-dollar denominated debt, is now in the hands of the Prime Minister and her advisors”.

While the details of the proposal have not been made public, Government is seemingly sticking to its original offer.

Meanwhile, a central banker is indicating that the March 31 deadline, which Government was working towards winding up negotiations and coming up with a mutually beneficial debt restructuring deal with external creditors, is no longer a reality.

Responding to questions at the Domestic Financial Institutions Conference at the Courtney Blackman Grande Salle on Thursday, Acting Deputy Governor of the Central Bank Michelle Doyle-Lowe said with March now coming to an end no new date has yet been identified for Government reaching a deal with external creditors.

“We are already at the ending of March. It is a negotiation and ultimately our ideal is to have it wrapped up because obviously it is creating unnecessary or additional uncertainty. But at the end of it there has to be some coming together of minds as to how we move forward,” said Doyle-Lowe.

“Remember we are dealing with international investors where their holding of Barbados Government debt is a very small element in their overall debt portfolio, but we know that at some stage we want to be able to partner with entities again and go back to the international capital market. So it is important how we proceed on these matters. So ultimately, there is no definitive date that I can say to you it will be completed by X time. Our ideal is that it be wrapped up sooner rather than later,” she explained.

About 20 per cent of Government debt is external.

“I think it is important to understand that there is a difference in perspective between your average domestic investor and the foreign investor. So it really relates to what they consider to be their stake and what they want to contribute to the reprofiling and overall exercise for Government to reposition itself,” Doyle-Lowe said.

“Part of it is related to them trying to understand where our economic fundamentals are at and what form the domestic exchange would have taken. But ultimately it is a case of creating some balance between them (external creditors) feeling comfortable that they are not bearing more than they want to in terms of the brunt of the external exchange versus what we need to achieve by way of repositioning the external debt,” she explained.

marlonmadden@barbadostoday.bb