The Prime Minister tonight touted what she considers a “BOSS” plan to rescue the Government from the fiscal crisis brought on by the COVID-19 pandemic while keeping public workers on the payroll.

BOSS is the acronym for the Barbados Optional Savings Scheme, which has replaced the initial forced savings and National Meeting Plan proposals. The new scheme was revealed by Mottley and Government’s Senior Economic Advisor Dr Kevin Greenidge.

Under the BOSS initiative, public servants whose monthly take-home pay is more than $3,000 have the option of converting between seven per cent to as much as 17 per cent of their paycheque into bonds.

Those who earn less than $3,000 a month also have the option to invest in bonds if they choose but do not have to. Those who are in a position to pay more into bonds can also do so.

Those Government bonds will mature in four years at an interest rate at five per cent per annum.

The Mottley administration projects that BOSS will create approximately $100 million in fiscal space for capital spending.

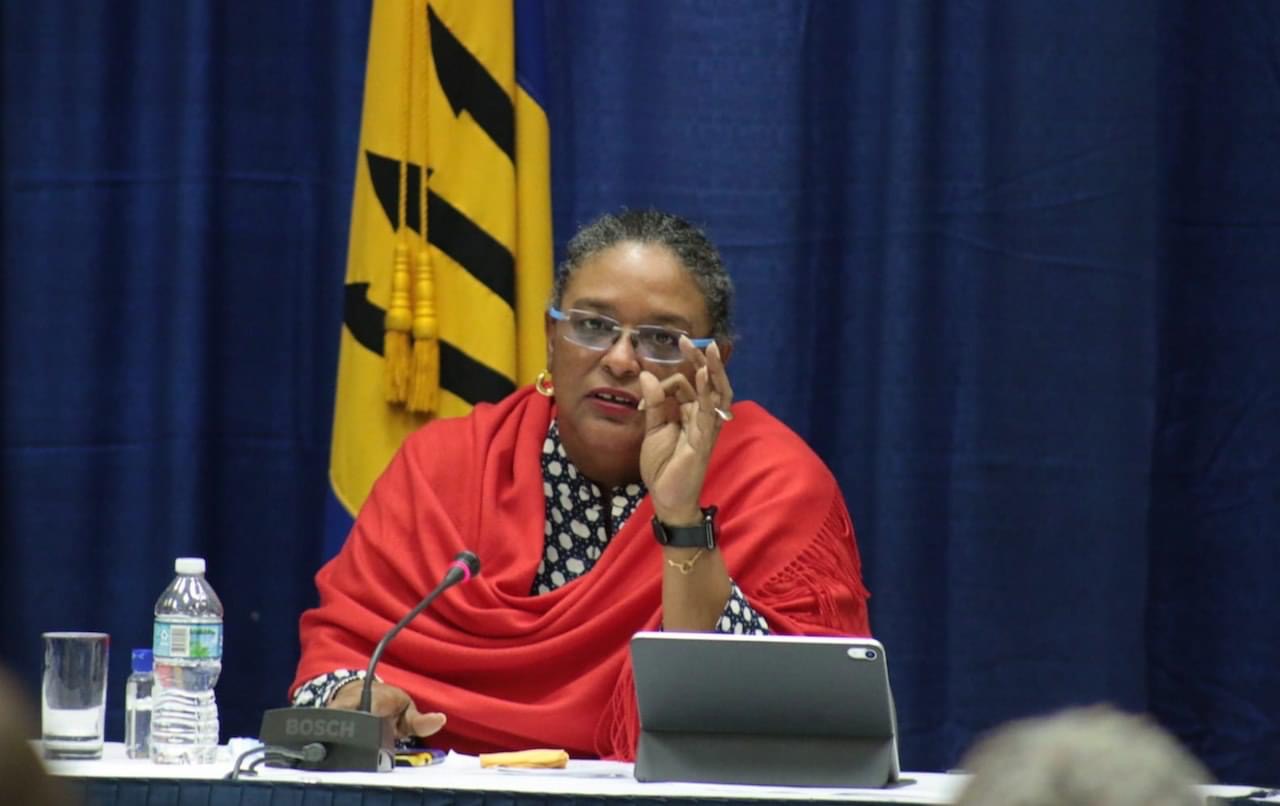

Speaking tonight during a press conference at Lloyd Erskine Sandiford Centre, Mottley maintained that the programme was optional and public servants who preferred to have their full salaries would be allowed to do so.

But she declared BOSS a “win-win” situation for all that would allow Government some wriggle room and ensure that thousands of public workers would keep their jobs in the midst of the negative fallout from the COVID-19 pandemic.

The Prime Minister said: “The programme is intended to benefit the needs of Government, which is that we need above the line to be able to recast some of our recurring expenditure and to put in place of it additional capital expenditure so that we can undertake aggressively, a number of projects that will allow us to be able to increase the number of persons who are working in the country.

“For this point in time, we believe that if we can repurpose close to $100 million of recurring expenditure through capital works that there will be a greater multiplier effect that will allow more Barbadians to be able to work whether it is in construction, roads, or water mains, or sick buildings being refurbished or schools that need to be repaired, or whether it is in cleaning up the country.”

Dr Greenidge explained that with Government estimated to lose between $450 million to $500 million in revenue due to COVID-19, BOSS was aimed at recouping around $100 million.

He reiterated that while the salaries of public servants would not be cut, the programme would allow Government to “absorb labour”.

But the economist also maintained that Government needed to find a way to reduce its annual $806 million wage bill.

He explained that public workers who opted to invest the bonds could stop at any time and convert their bonds into cash.

He said some of the bonds’ features were that they were fully tradeable and protected. The withholding tax on the interest earned had also been waived, he said.

Dr Greenidge said the decision to invest in the bonds should be a “no-brainer”, considering the extremely low interest rates currently being offered by commercial banks.

“It makes good sense. It is a no brainer in terms of it makes investment sense,” he said.

The economic adviser said while the private sector could also invest in the bonds, Government was targeting workers in the public sector for saving in an effort to reduce its wage bill.

Dr Greenidge told journalists: “Private sector buying is good, but not for this purpose because Government doesn’t pay private sector wages so we don’t save anything by the private sector paying.

“The private sector can play a role if a worker wants to sell his bonds, then a senior transaction would happen through the Central Bank. Credit unions, corporations, individuals with access would be able to go ahead and buy it.”

randybennett@barbadostoday.bb