By Emmanuel Joseph

Barbados has recorded its largest three-quarter economic growth in 17 years as it grew over ten straight quarters, the Central Bank said Friday, declaring an impressive rebound from the COVID-19 pandemic which was led by the country’s main foreign exchange earner, tourism.

The economy grew by 4.4 per cent in the first nine months of 2023, the biggest comparative expansion since 2006, excluding the pandemic recovery period last year when it improved by 17.3 per cent “because it was coming from a lower base”, said Governor Dr Kevin Greenidge in the bank’s latest economic review from January to September.

Unemployment continued to fall, he said, as the unemployment figure dropped in the second quarter to 8.5 per cent.

“The unemployment rate declined from 9.3 per cent in the second quarter of 2022 to 8.5 per cent by the end of the same period in 2023. Employment in the wholesale and retail trade and the transport and communications sectors rose relative to the same period last year, with the improvement in overall economic activity,” the governor said. “Additionally, there were other key indicators of labour market recovery: more job seekers spent fewer than three months searching for work; unemployment claims continued to trend around pre-pandemic levels. With more workers retiring, the labour force participation rate contracted by 1.9 percentage points.”

The governor told journalists: “This performance also accounts for the 10th consecutive quarter of economic growth. Broad-based growth boosted tax collections, improved labour market conditions, reduced the debt-to-GDP ratio, narrowed the trade deficit, increased foreign reserve levels, and improved credit quality as well as bank profitability.”

He announced that Barbados’ external position also strengthened during the year up to September.

“The current account deficit narrowed by $156.1 million relative to the comparable period of the previous year, resulting in a deficit of $805.9 million. An upswing in tourism receipts and a decline in the value of imports led to this outturn. The external position also benefited from increased policy-based loan inflows. Consequently, the gross international reserves expanded by $88 million to reach $2.9 billion, equivalent to 30.3 weeks of imports of goods and services,” he revealed.

The government also achieved its primary surplus target set under the Barbados Economic Recovery and Transformation (BERT-2022), the International Monetary Fund-supported austerity programme, Dr Greenidge reported.

He said the continued improvement in economic activity coupled with the “timely” transfer of taxes levied on external transactions, contributed to this outcome.

But the central governor highlighted some negative impacts on the government’s finances. Firstly, changes in the time the government collected taxes on profits and properties meant it did not get as much revenue as expected. Additionally, the government had to pay more in interest costs and spent more on state-owned enterprises and higher wages and salaries for public servants. As a result, the government spent more than the revenue it had hoped for.

“A shift in the timing of taxes on profits and properties offset some of the revenue gains. Higher interest costs, transfers to state-owned enterprises (SOEs) as well as increased wages and salaries pushed up spending,” Dr Greenidge said.

The government still recorded a primary surplus of $274.9 million (2.1 per cent of GDP), with a target of $218 million, and an overall fiscal deficit of $61.1 million (or -0.5 per cent of GDP).

The governor reported a slight shrinking of the debt hole that still swallows the entire value of the economy, measured as the gross domestic product (GDP) – to 115.4 per cent on account of increased economic activity.

It was economic growth that the governor said was the reason for improved financial sector indicators over the first nine months of this year.

This performance was marked by increased credit to businesses and robust financial stability indicators, he said.

The quality of credit continued to strengthen, while capital adequacy and liquidity ratios remained elevated, according to the central bank.

Turning to tourism, Dr Greenidge’s message was that it continued to spur the country’s economic expansion during the first three quarters of 2023.

“Intensified marketing campaigns in key source markets, increased airlift, sporting events, and a full return to Crop Over festivities fuelled the continued recovery in the tourism sector,” he said. “The growth in the tourism industry boosted construction and other non-traded activities. Overall, non-traded sectors contributed just over half of real GDP growth.

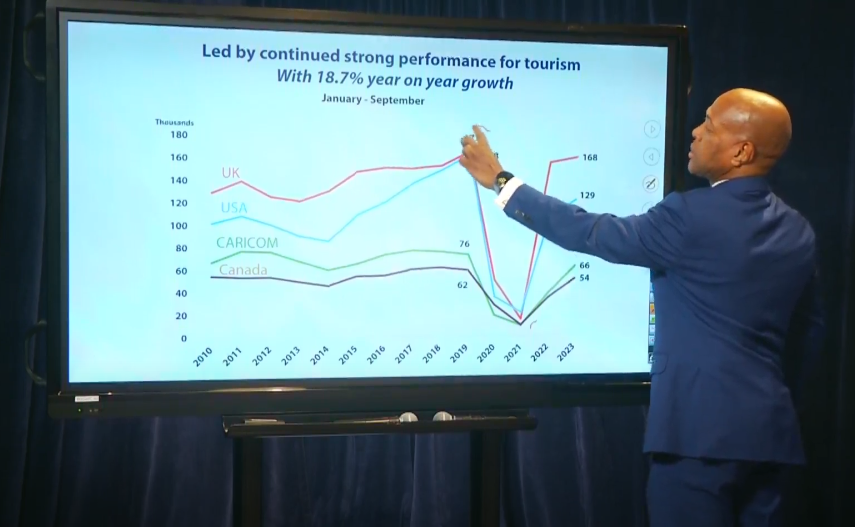

“Tourism recovery accelerated during the summer. Increased marketing efforts and airlift expansion led to a significant improvement in visitors from the United States. Arrivals from the UK, Barbados’ largest tourism market, were just slightly below 2019’s level as that market continues to perform strongly. The full itinerary for the Crop Over festival and Caribbean Premier League cricket matches also drew higher numbers of Caribbean visitors.”

He announced that by the end of September this year, long-stay arrivals rose by 18.7 per cent above the comparable figure for last year, representing more than 450 000 visitors.

“However,” the Central Bank head said, “long-stay arrivals are still below the pre-pandemic average of 502 000 visitors. Airline seating capacity improved significantly in the first nine months of 2023 relative to the same period last year, though not yet back to pre-pandemic levels.”

Dr Greenidge disclosed that the strong tourism performance supported growth in occupancy and revenues for accommodation.

“Heightened demand for accommodation resulted in a 3.3 per cent year-to-date increase in hotel occupancy rates. Increases in average daily room rates resulted in a 7.1 per cent rise in revenue per available room (RevPAR). In the sharing economy, occupancy rates and RevPAR for the “entire place” rose by 5.2 per cent and 5.8 per cent, respectively. Booked room nights in the sharing economy increased by 4.5 per cent over the first nine months of 2023,” the economic review stated.

emmanueljoseph@barbadostoday.bb