Barbadians who own two-acre properties or larger classified as agricultural land by the Development Planning Office are being asked to pay significantly higher land tax rates, Barbados TODAY has learned.

Some residents are now being told to pay approximately 1 000 per cent more for land tax.

But in a stunning admission, the Barbados Revenue Authority (BRA), while confirming a householder’s new high rate, acknowledged the likely “inequality or lack of fairness” in the bill’s sticker shock.

At issue is whether large agricultural plots qualify for the new rates where owners have built their primary home on the land – a distinction that usually attracts a lower standard tax rate.

The development was revealed in correspondence by the BRA’s land valuation and assessment technical specialist, Kevindale Carter, to residents of Sandford, St Philip, who protested their recent land tax bills, people who own properties of two acres or more are now required to pay 0.95 per cent on the improved value of their land.

Carter said the BRA had made a mistake in previous years by billing these property owners in line with residential rates and was now in the process of correcting the error.

Last week, Government backbencher Dr Sonia Browne made a direct, personal appeal to her parliamentary colleagues for relief from the land tax assessed on her home, as she claimed some of her neighbours were carrying a similar burden. Saying that the matter was also a concern for her rural constituents, the St Philip North MP told her colleagues: “I opened my land tax bill last year and almost had a seizure. It moved from $3 300 roughly to $8 300”.

Dr Browne said she was bringing the matter to the attention of the legislators and the public in the hope that she would see some relief. She further told the House that she had “pleaded” with the Minister in the Ministry of Finance Ryan Straughn and “really got nowhere”.

Following her outcry, other residents in the Sandford community also complained to Barbados TODAY about their experience with high bills.

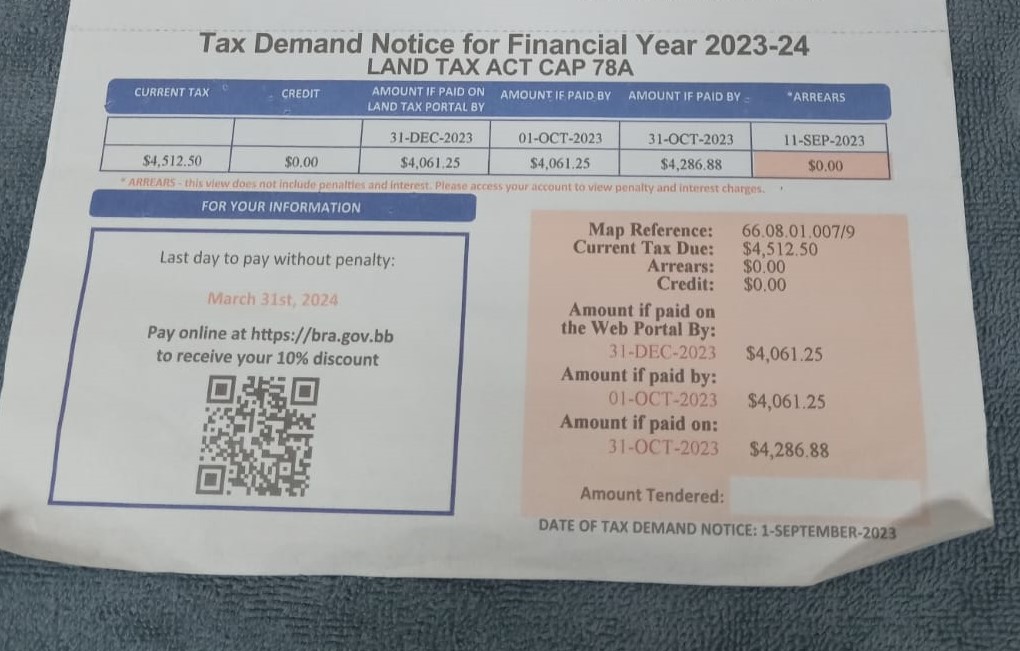

Peter Bradshaw, who presented his latest bill and several past bills, went from paying $427.50 in financial year 2022-2023 to receiving a bill for $4 512.50 in 2023-2024.

Adamant that he did not intend to pay that amount, he objected to the tax claim which was sent to him on September 1 last year. In a letter dated December 11, Carter, who wrote on behalf of the Revenue Commissioner Louisa Lewis- Ward, told Bradshaw that the previous amounts he was being asked to pay were incorrect and the current bill was now the correct amount due.

Carter also said all Sandford residents who had two or more acres of property would have adjusted bills.

“The Development Planning Office (DPO), formerly the Town and Country Development Planning Office (TCDPO) determines land use in Barbados. These lots are all classified as agricultural land by the DPO. All lots 2 acres or more in developments have been determined by the DPO as agricultural land. The Barbados Revenue Authority does not classify lands, but values and taxes are based on the DPO classification. When these lots are vacant they are valued and taxed as agricultural lands. That should not change because a house is built on the land. The department erred in changing the category from agricultural to residential for those with houses. This error is now being corrected,”

Carter said, adding that there is a “50 per cent rebate available to those that use the land to produce agriculture for sale”.

Bradshaw, who owns a two-acre plot, questioned the BRA official’s logic.

“I see nothing in the Land Tax Act that speaks to what he is saying,” Bradshaw said.

Quoting Section 6A of the Act, he said: “Where a person owns land on which a dwelling house is erected and the dwelling house is used exclusively as a residence, that person shall pay tax at the rate specified under Section 6(1)”.

Section 6(1) states that tax shall be levied and paid at such rates specified.

The improved value of Bradshaw’s land is $475 000. According to BRA’s website, people with improved land for residential purposes pay 0.7 per cent on the excess of the improved value greater than $450 000 but not exceeding $850 000.

“His argument is that all those other people that aren’t paying what I am paying, they are doing so by error and it’s going to be fixed. But if that happens that would have a significant impact. There would be a big outcry from people in this land. That means that I have to pay the government nearly $400 every month to rent my own property. This doesn’t make any sense to me,” Bradshaw asserted, adding that he was aware of “at least two of my neighbours who objected to their bills and they dropped it back to residential”.

Bradshaw, who has been living in the St Philip district for about 23 years, said that having not been satisfied with the response, he visited BRA on several occasions and wrote again to the Revenue Commissioner.

In a letter dated January 31 this year, BRA insisted that the tax bill was indeed accurate. But the revenue agency added that it was sorry if the assessment was unequal or unfair.

It said: “We have established that the land is agricultural land as classified by the Planning and Development Department, formerly Town and Country Development Planning Office. We acknowledge that all of the lots are similarly classified. We have examined the taxes levied on your property . . . which is a lot of 2.0 acres in an agricultural subdivision, and found that the tax rate of 0.95 per cent is correctly applied to the value. The department will continue working to bring all such properties to the appropriate rate of tax applicable to agricultural land.

“On behalf of the Revenue Commissioner, we apologise for any inequality or lack of fairness in the assessment of the tax demanded for land in your environs.”

In a statement over the weekend, BRA’s manager of communications and public relations Carolyn Williams-Gayle, said the authority was in the process of bringing tax rates for properties up to date with their prescribed usage.

“With reference to land usage, the Land Tax Act makes reference to property owners of land under agricultural use who may have a dwelling house on that property, and in referencing the agricultural rebate, the Land Tax Act CAP78A (8A)(3) states that land that is under cultivation is not to be treated as not being used exclusively for agricultural purposes by reason only of the fact that a dwelling house or other building is erected thereon.

“The Barbados Revenue Authority’s remit is to value and tax the land according to the prescribed land usage. As land usage determinations are made, we have been working on bringing the tax rates for properties up to date with the prescribed usage. This is an ongoing process. Any application in respect to a change of land usage would have to be made with the Planning and Development Department,” Williams-Gayle said.