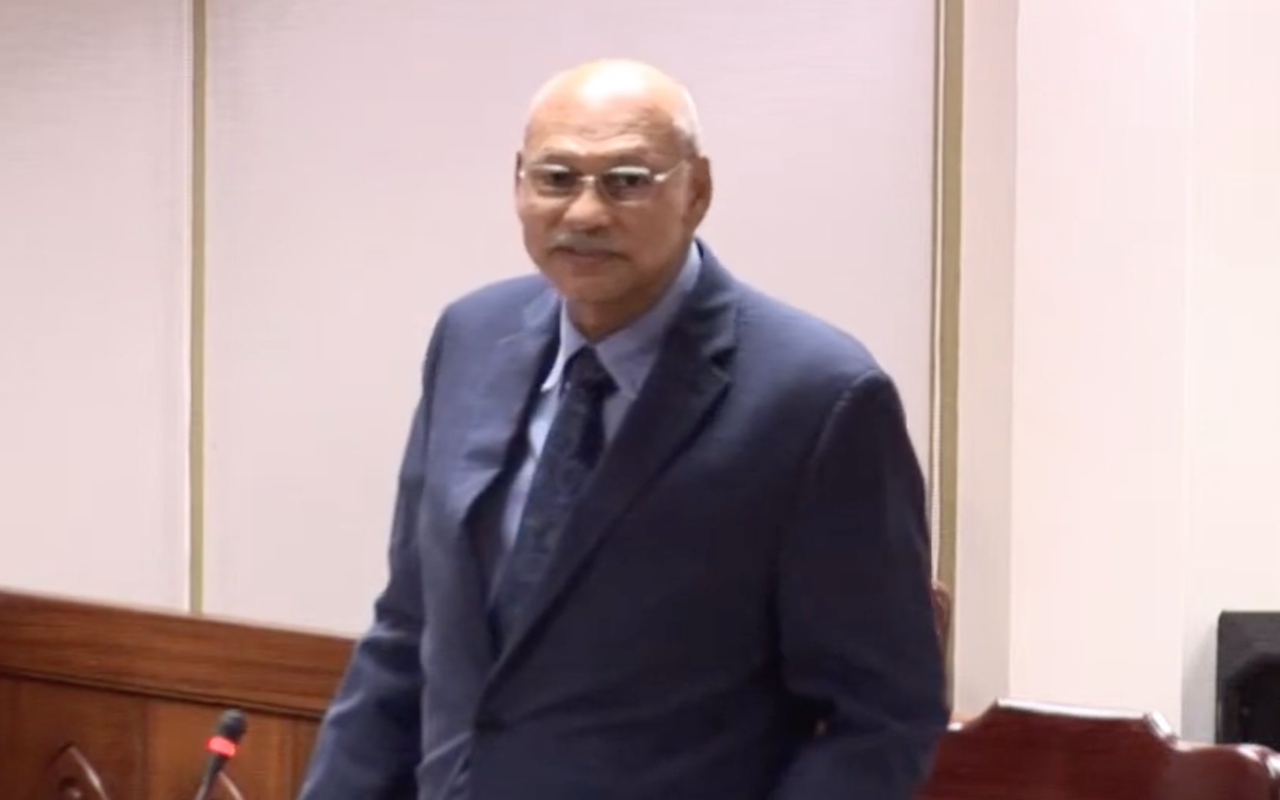

Taxes paid by entities in the international business sector (IBS) have exceeded expectations and have given Barbados’ foreign reserves a significant injection, Minister of International Business Ronald Toppin said Tuesday.

He made the disclosure as he introduced the Companies (Economic Substance) (Amendment) Bill, 2021, which was later passed in the House of Assembly to bring the country in line with European Union (EU) requirements.

“I can say, without giving the details, corporation taxes have performed better than expected and, in fact, they have exceeded projections as of June 15, this year,” he said in providing an update on the IBS.

“This better-than-projected corporate tax take has boosted Barbados’ foreign reserves at the Central Bank; and I can go further and say that this has resulted in a reduction of Government’s overdraft facility at the Central Bank as well.”

In further pointing to the contribution of this industry, Toppin highlighted that the Central Bank Governor recently reported international business accounted for the majority of $612 million in corporate tax earned between April 2020 and March 2021; and the Barbados International Business Association (BIBA) also pointed out that the sector was the only one to add to corporate tax revenue, with a 15 per cent increase for the last 12 months.

“So, this sector has been resilient. It has been one of those sectors that has had its share of trials and tribulations over the last year or more. We’re dealing with constantly shifting goalposts, dodging bullets, but the sector has been as resilient as could be expected in the circumstances,” Minister Toppin said.

The Companies (Economic Substance) (Amendment) Bill, 2021 was introduced to include partnerships formed in Barbados, which are carrying out one or more relevant activities, – banking business, insurance business, fund management business, finance and leasing business, headquarters business, shipping business, holding company business, intellectual property business, distribution and service centre business – among entities that must conduct their core, income-generating activities here in order to benefit from the island’s low corporate tax rate of 5.5 per cent.

Economic substance legislation was first passed in 2018 but repealed in 2019 and a new law enacted under pressure from the European Union (EU), which was not satisfied with the Companies (Economic Substance) Bill that was among 14 pieces of legislation passed in 2018 to meet the requirements of the Organisation for Economic Co-operation and Development (OECD).

With various countries addressing the issue of economic substance legislation differently, the EU sought uniformity for all low-tax jurisdictions and Barbados was asked to comply by July 1.

“We intend to be and remain being a financial services centre of excellence. We have to be very well regulated and, therefore, Mr Speaker, that is the context in which the short Bill that is before us today, is before us,” Toppin said.

Toppin noted that other Caribbean jurisdictions also have to enact similar legislation.

“On this occasion, I can’t say that Barbados has been targeted singly in this whole exercise because it has also been required to done in other jurisdictions – Anguilla, Bermuda, BVI, Cayman Islands, Guernsey, Isle of Man, and Jersey. All of them also have to include partnerships in their domestic economic substance legislation,” he explained.

However, the Minister said he did not exact much to change as a result of the amendment which was required of Barbados.

“In terms of real impact, I don’t know that this is anything that we would have to lose a lot of sleep over, quite frankly, because in 2016 there were only some 22 limited partnerships; general partnerships, I think there were less than 100 of those. So, in real terms, I don’t know that it’s going to be a big deal. Furthermore, partnerships will only be subject to the requirements of the economic substance legislation, which is filing annual economic substance declarations and so on, if they engage in relevant activities – banking, etc. – “….Historically, partnerships in Barbados have largely engaged in accounting firms, law firms and perhaps some medical activities as well.”

While not opposing the amendment, Opposition Leader Bishop Joseph Atherley disagreed with Toppin that there would be no change in the status quo for partnerships under the legislation.

“The dynamics are such today that I expect that that particular configuration of business entity that we know as partnership will change in multiplied instances and…my Honourable friend, 10 years from now…he will speak in this vein and he will refer to numbers multiplied many times before those numbers which he gave,” he said.

(DP)