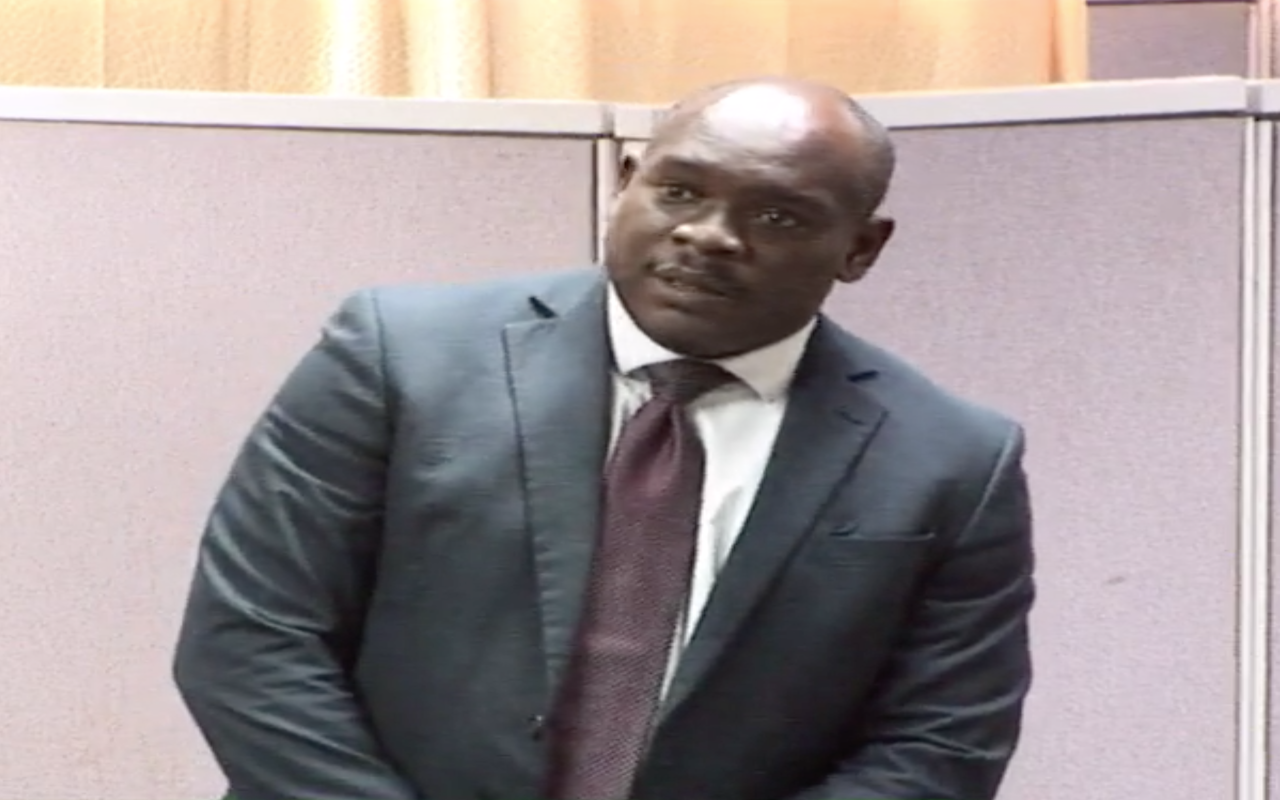

Minister in the Ministry of Finance Ryan Straughn has rejected outright a suggestion from the Opposition Leader that Government was deliberately keeping bank interest rates low to make Government paper such as bonds, more attractive.

Straughn, who was speaking in the House of Assembly session being held at the Worthing Corporate Centre, Christ Church, said that it might have been the policy of the former Democratic Labour Party (DLP) administration in its waning years, but it is not the policy of the current Government.

Speaking on the Central Bank of Barbados Bill 2020, the minister said the suggestion that this was a Government policy was wrong.

In fact, Straughn insisted Government had not issued any new bonds since October 2018. He described the current bond arrangement with civil servants as a “private placement” which officers could retain or they could sell on the open market.

Rejecting the charge by Bishop Joseph Atherley, the minister in the Ministry of Finance said “there would come a time when Government will not need” to raise financing through the issuance of debt.

At the same time, he contended there was “still appetite” for debt in the market, however, a decision would be taken by Government to “dip its toe” back into the issuance of new debt in order to recapitalize the Central Bank of Barbados.

He called for the Central Bank to focus more on the performance of commercial banks and the stability of the financial system. In this connection, he said there should be greater collaboration between the Central Bank and the other supra-regulator, the Financial Services Commission (FSC).

The FSC regulates credit unions, insurance companies, the stock market, pension funds and mutual funds, while the Central Bank regulates commercial banks and other registered non-bank deposit-taking financial institutions.

According to the Straughn, the Barbados economy had been impacted by significant disruption due to the COVID-19 pandemic. However, what was required now was a trajectory of growth.

Contending that the Mottley administration was now repairing the neglect of the previous government, he argued that they were not “building back system by system and institution by institution”.

Straughn insisted there was an information gap existing which was affecting investors and Government was committed to pushing ahead with the reform of institutions even though some people were more comfortable with the status quo. (IMC1)