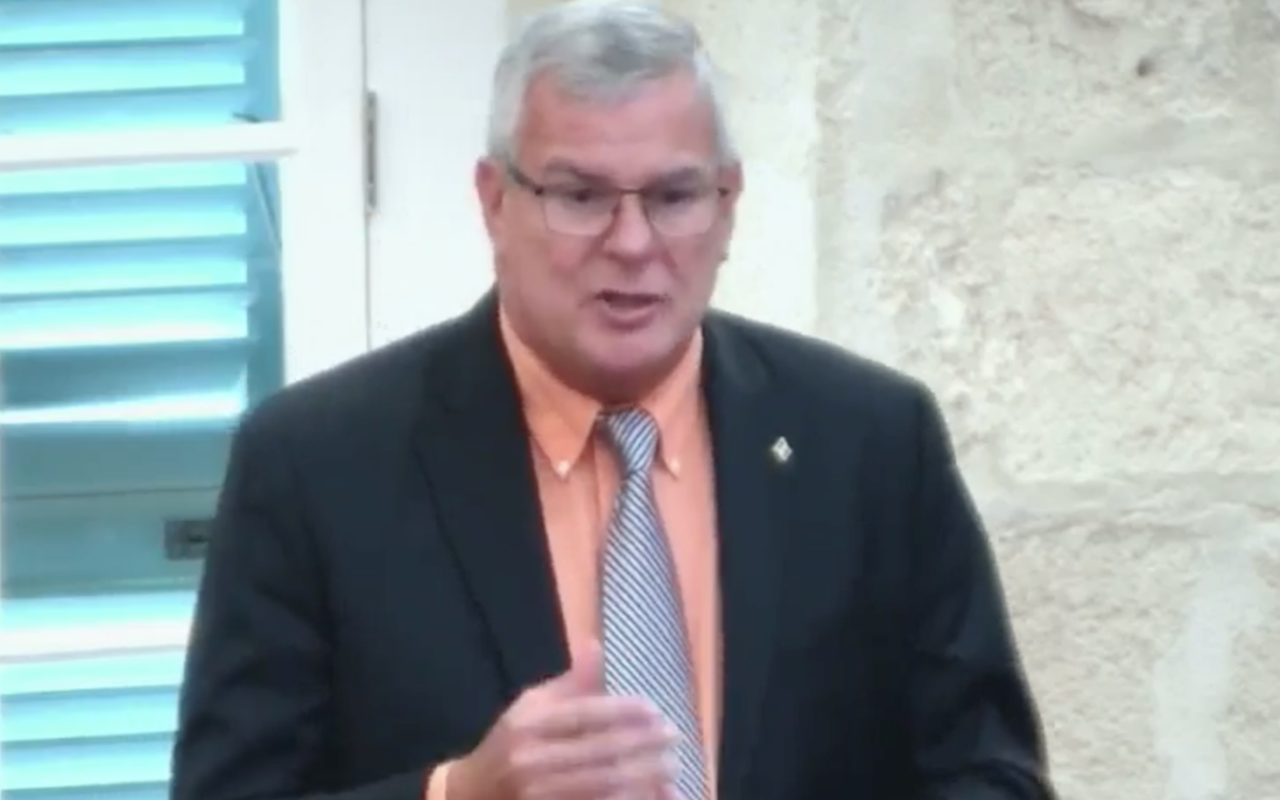

Independent Senator Andrew Mallalieu has described the Pandemic Contribution Levy announced by Prime Minister Mia Amor Mottley in last Monday’s Budget speech as “unfair”.

In his opinion the narrow scope of application of the tax to a defined set, makes it inequitable.

“I would have preferred if we were all in this together. It is clear that if you have made profit you could afford to pay some more tax. And I think personally that all the businesses should have been asked to play a part, not just some in certain industries that we might think have avoided the worst of it because we frankly did not know who benefited, who was resilient enough.

He shared his views while contributing to the debate on the Appropriation Bill, 2022 in the Senate Chamber. The businessman, in his first speech since joining the Upper Chamber, lamented that the levy does not take account of those businesses in other areas not included in the catchment outlined but which may have been more resilient or may have even benefited from the pandemic.

“I give as an example one that I am well familiar with, an industry that did not exist before the pandemic, that is an industry of PCR testing. At one point we were testing 3000 people per day. We were struggling to reopen our tourism economy. People were coming back but we were requiring tests of people. It was a difficult time. Many private businesses were formed out of that and at that time they were charging BDS$300 per PCR.

“If one quarter of those 3000 people per day were tested privately that was $225 000 per day in revenue. So, we never know where one might profit in a pandemic and I am not saying they did it intentionally or with any bad motive. We needed it. What I am saying is it did happen.

“PPE [Personal Protective Equipment] was needed and many entrepreneurs set about and did a good job. There were many things that needed to happen and certain businesses did in fact prosper as a result of the pandemic, not in a malicious way,” Senator Mallalieu said.

The pandemic levy will be applied at a rate of 15 per cent of the net income of companies in the telecommunications and commercial banking sectors, retail sale of petroleum products and general and life insurance industry that have a net income above $5 million in 2020 and 2021. The levy was designed to get these commercial entities to contribute to the Government’s $1 billion COVID-19 bill.

Mallalieu said he is concerned about the retroactive nature of the pandemic levy which is being imposed on select industries. He said while he appreciates that the tax is to be paid in the future, he is concerned that it is being calculated on results of the past, creating an environment of uncertainty for businesses.

The businessman said in his opinion, the levy is unfair because it singles out players in a particular industry.

“I support completely the notion of a pandemic levy that would get us to pay back what it costs us during that period in the quickest possible time, so that we do not leave this pandemic as a legacy for generations to come, but we deal with it now. I believe the proposal is correct, but the proposal is unfair in addressing only certain industries and certain players within those industries,” he said.

Repeatedly insisting that the principle of choosing the businesses to be taxed is not right, the Independent Senator said the question of who is next to be taxed should be answered.

anestahenry@barbadostoday.bb