How we got here

Historic, trail-blazing roots

In October 1937 Barbados became the first country in the world with a majority population not of white, European racial origin to grant universal pension rights to its citizens.

The pension was non-contributory, means-tested and paid to all who were over 70 and had been resident for 20 years or more. Within the first year of operation starting on May 1, 1938 over 4 000 pensioners were covered.

The 1937 legislation marked the moment at which care of the poor and elderly changed from being hit-and-miss charity work or an act of kinship to an obligation on the part of the State to honour the absolute right to a pension. This extraordinary policy benefiting all, was won at a time when less than four per cent of the population – notably all men of relative means – had the vote.

The 1967 NIS design

Much has changed to our pension system since those modest beginnings in a politically repressive era. Yet throughout, the country has sought to hold in balance three, sometimes conflicting, goals: first, that there is continual improvement to social security in terms of benefit adequacy; second, that contributions financing benefits are affordable; and third, that the overall system is financially sustainable.

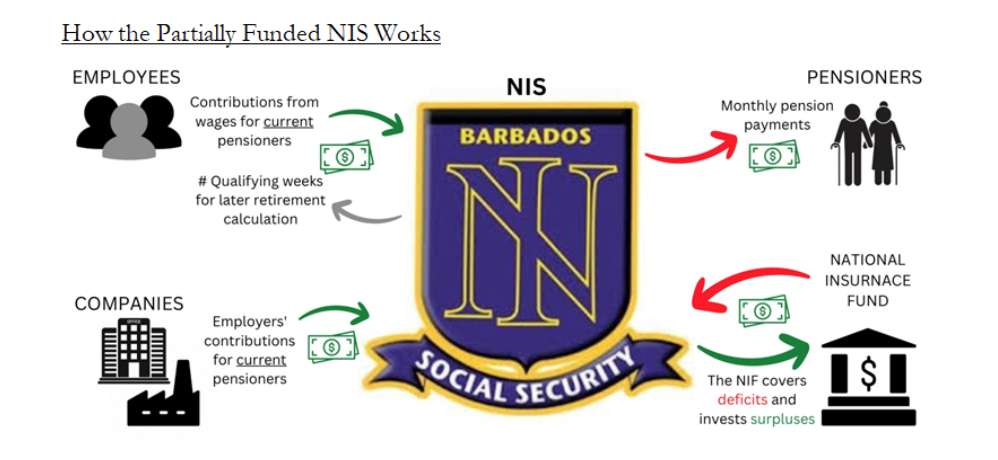

Pursuit of those goals and balance led in 1967 to the current National Insurance Scheme (NIS) hybrid pay-as-you-go/partially funded contributory model depicted in image:

At the time this was a logical evolution as the model was ideally suited for the 1960s:

The real economy measured by Gross Domestic Product (GDP) grew at a remarkable 6.8 per cent average rate annually between 1960 and 1970 almost doubling in size. This drove new jobs, increasing wages and, with them, rising contributions.

The population was young with a median age of 20 and relatively few pensioners to be paid and many workers to finance them.

The total fertility rate (TFR), the source of future contributors, was high at 3.6 children per woman.

Why we must Revitalise for the 21st century

Today the context is vastly different:

Real economic growth has been stagnant. Average annual GDP growth between 2003 and 2019 was 0.62 per cent. Including the COVID years to 2022 it was 0.35 per cent per year. And in ten of those years real GDP per capita growth has been negative.

The country is much older with a median age of 39. Moreover, Barbadians are living longer. Today, someone aged between 65 and 69 can expect to live another 18 years – four years more than in 1967. Since 1967, in contrast, the retirement age has increased by a mere two years from 65 to 67.

We are having fewer children – the TFR today is 1.6. Any number below two means the population is shrinking. Combined with an older population this means we are increasing benefit spending whilst simultaneously reducing the contributor base.

Our 1967 system cannot survive these 21st century forces. Since 2016 they are the primary factors behind the NIS’ growing deficit between benefit expenditures and contribution income. We have a generous minimum pension guarantee and, if undealt with, these deficits will leverage that generosity into a chasm of unsustainability.

How? Those deficits have been met thus far by National Insurance Fund investment income from its portfolio. That portfolio is worth $4b today. Nonetheless, in the absence of corrective actions the $4b will be driven to zero by as early as 2036 as the underlying investment assets are liquidated to meet the rising deficits. That would not end the NIS but it would mean the pay-as-you-go rate would rise to between 27 per cent and 34 per cent to compensate.

That is an unacceptable prospect and is why the NIS Revitalisation Reform process was launched immediately after the publication of the 17th Actuarial Review. Revitalisation’s goal is that the 21st century NIS evolves and restrikes the fairest balance possible between adequacy, affordability and sustainability such that an absolute level of financial dignity and protection for all current and future retirees continues to be guaranteed.

Rawdon Adams is the Deputy Chair of the NIS ]]>