Barbadians need to be better educated now more than ever on achieving financial freedom.

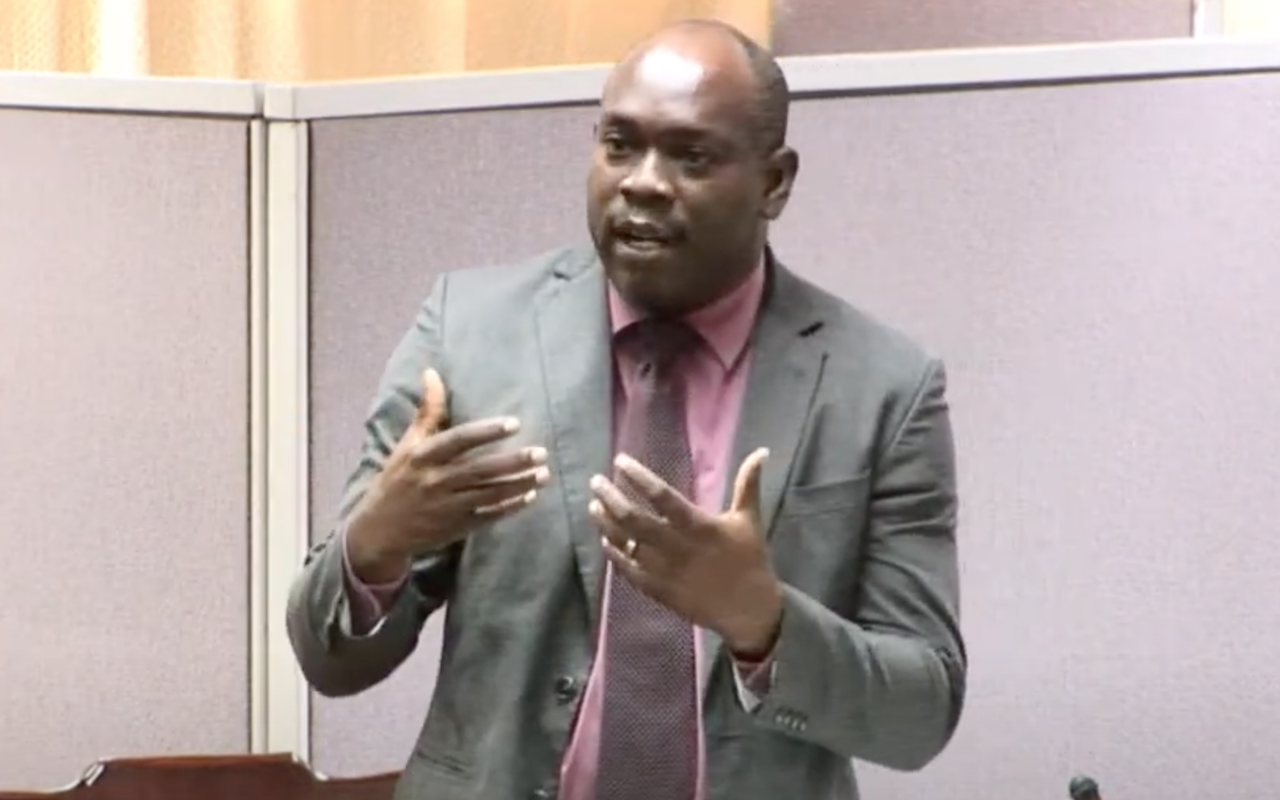

That is according to Minister in the Ministry of Finance, Economic Affairs and Investment, Ryan Straughn, who believes the economic hardships created by the COVID-19 pandemic has made it imperative for persons to become financially literate.

He made the comments while speaking during the Barbados Association of Insurance and Financial Advisors’ (BARAIFA) ‘Blast Off Seminar’ this morning held under the theme ‘The Awesome Benefits of Financial Literacy’.

Straughn described get-rich schemes such as blessing circles as “fraud and criminal” and warned persons not to get involved.

“One of the things we must establish from the outset is that decision-making in an environment where there is so much information circulating is something that we all must work together to try to combat,” Straughn said.

“I believe we all have to work together very aggressively and I can’t underscore the importance of it to combat misinformation getting into the public domain and influencing people’s decision-making on a daily basis. I start here because certainly during this pandemic we have seen a proliferation of schemes and fraud proposals being circulated globally and certainly Barbados has not been exempt from that.

“…And I think that as we seek to work together to push and forge ahead with respect to creating a climate where persons can trust the information they are receiving and that they can make those decisions that are truly in their best interests, I believe broadening the scope and the application of what is known as financial literacy is going to be absolutely critical,” the minister added.

Straughn said while BARAIFA’s focus was on insurance he suggested that they could expand their services to offer other financial services.

He maintained that they were perfectly placed to do so.

“I know that there is a sense of formality as it relates to whether it is the buying of an insurance product, which banking products one may or may not engage with, the reality is that there are a whole set of other opportunities that I believe BARAIFA can play a role, even though I know that you are structured and perhaps aligned to specific insurance companies, I think what is being contemplated as part of the Government is to move forward and to create wealth such that it can be passed on from one generation to a next, I think is absolutely, absolutely critical,” he said.

Straughn gave the assurance that Government would continue to push to broaden the scope with respect to participation in investment opportunities in the economy.