by Marlon Madden

The Mia Mottley administration has contracted the services of the Chicago-based financial crime detection and prevention firm, ACAMS (the Association of Certified Anti-Money Laundering Specialists) for

another year.

ACAMS, a subsidiary of Adtalem Global Education, the parent company of Ross University, has been offering specialised services to Barbados in the area of anti-money laundering for more than a year, helping the country to meet many of its international requirements.

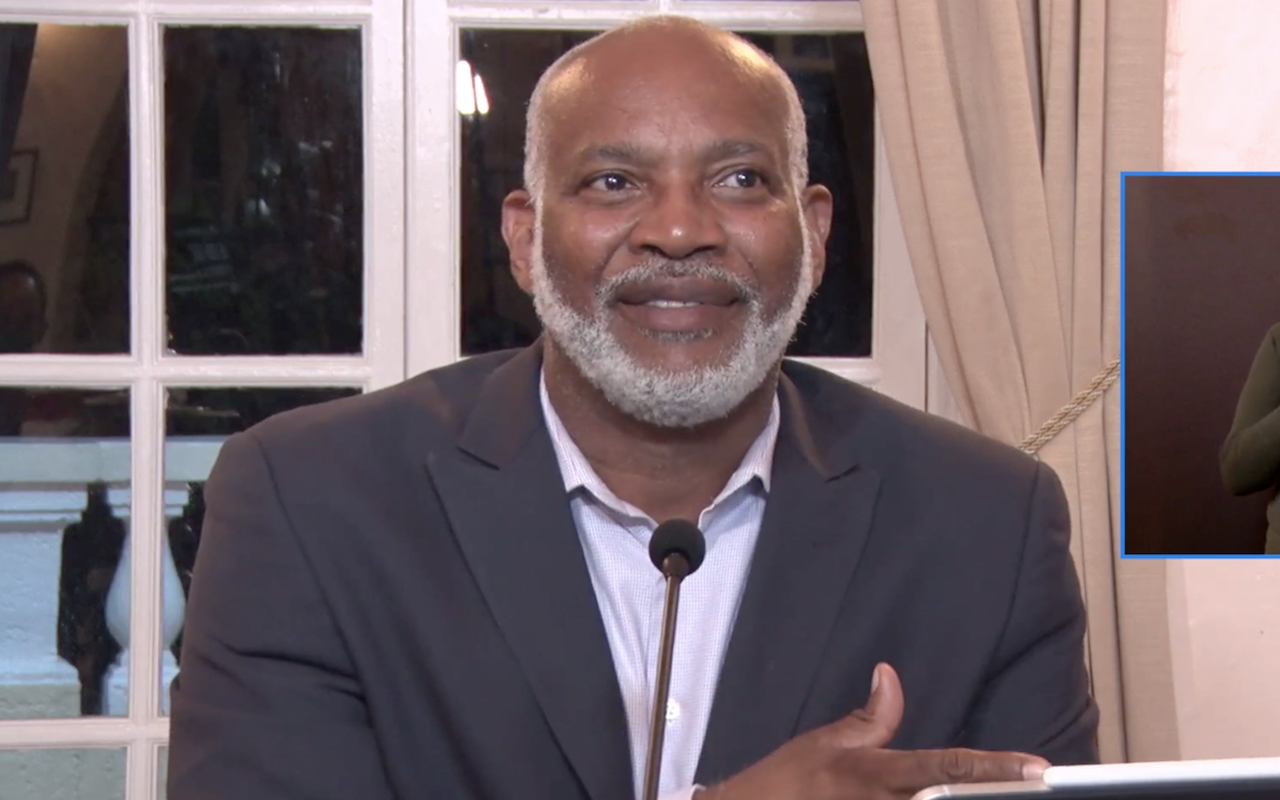

Attorney General Dale Marshall sought and received a total of $1,877,894 in supplementary funding for “professional services”, of which $1 million was for consultancy fee to ACAMS and the remaining $877,894 for other legal and consultancy services.

Marshall told lawmakers in Parliament recently that Barbados has benefited “tremendously” from the work done by ACAMS so far.

Stating that ACAMS came to Government’s aid

when it was battling with issues relating to blacklisting, he said: “ACAMS, in the area of money laundering, made available for the government of Barbados

for the period of one year, specialists in the area

of anti-money laundering to help us chart our way

through that process”.

Suggesting that the company was offering its services free of charge at one point, Marshall said: “there comes a time when you can’t get everything for free, and we have so valued the hard work that those individuals and specialists put in that 18 months ago

we went beyond a gratis arrangement and contracted with ACAMs to provide these services to the government of Barbados now on a paid basis”.

He said it was necessary to have specialists to help the island come off the EU’s blacklist and meet other anti-money laundering requirements.

“That blacklist has the potential to wreak havoc in our commercial landscape. As a result of being on that blacklist, it has affected the ability of a lot of corporate entities to do cross border business,” he said.

“So Barbados has committed to the Financial Action Task Force to reform a number of areas – some

dealing with beneficial ownership of companies, some dealing with the regulatory framework, some dealing with how we spot and investigate money laundering – and in each of these areas there are standards that

are set out.

“So we have spent a lot of time and effort since coming to government on trying to transform and reform our systems that we can meet the standards of the Financial Action Task Force, and in the process, make our way safely off the EU’s blacklist,” he said.

Barbados was placed on the blacklist of the EU Council in May 2020 as being a “non-cooperative jurisdiction for tax purposes”, after the OECD Global Forum’s classification of Barbados as “partially compliant” at the end of its review period in March 2020.

Again in October 2020, the EU said it would be keeping Barbados on its updated list. However, in March this year, the EU removed Barbados from its so-called blacklist to a grey list.

Making a case for the continued services of ACAMS, Marshall said despite the work done so far, there were some lingering challenges.

“We have some challenges in our country, and those challenges present themselves not just in this area (money laundering), but across many of the areas of governmental activity, and that has to do with the availability of specialised human resources to help us navigate these complex areas,” he said.

He disclosed that local officers at the various regulatory bodies, including the Financial Services Commission, the Financial Intelligence Unit (FIU) and the Royal Barbados Police Force (RBPF), were “currently receiving training from individuals who have flown in specially to do that,

and therefore this consultancy is one that has been giving us tremendous benefit”.

“The net effect of this is that we have been able to steadily make gains in terms of our commitments to the Financial Action Task Force and we are targeting coming off of the EU [grey list] early in 2022. That would represent a tremendous gain for the government of Barbados,” he said.

In relation to the supplementary Estimates for the private legal and consultancy services, Marshall explained that it was necessary since the Office of the Solicitor General was small with only about 20 lawyers that were “divided into litigation, contracts and advisory”.

He said while the number may seem a lot to some, “those lawyers do work for every single arm of government. Just about every single piece of legal paper that has to pass through or has to do anything with the government of Barbados, it makes its way through the Office of the Solicitor General”.

Adding that the department was overworked, Marshall pointed out that there were hundreds of cases filed every year that required input from that office.

He also made it clear that the Mia Mottley administration was paying only “a fraction” of what previous governments would pay for similar services.

“We are insisting on accountability, transparency and best of all, we are getting value for money,” he said, adding that some of the $877,894 was for services already carried out under the previous government.

“Not one of the invoices that have come to the government since I have been Attorney General getting private lawyers to do work, not one of them has added up, in all, to more than $250,000. Not one. The raping of the coffers of the state is at an end,” he declared.

marlonmadden@barbadostoday.bb