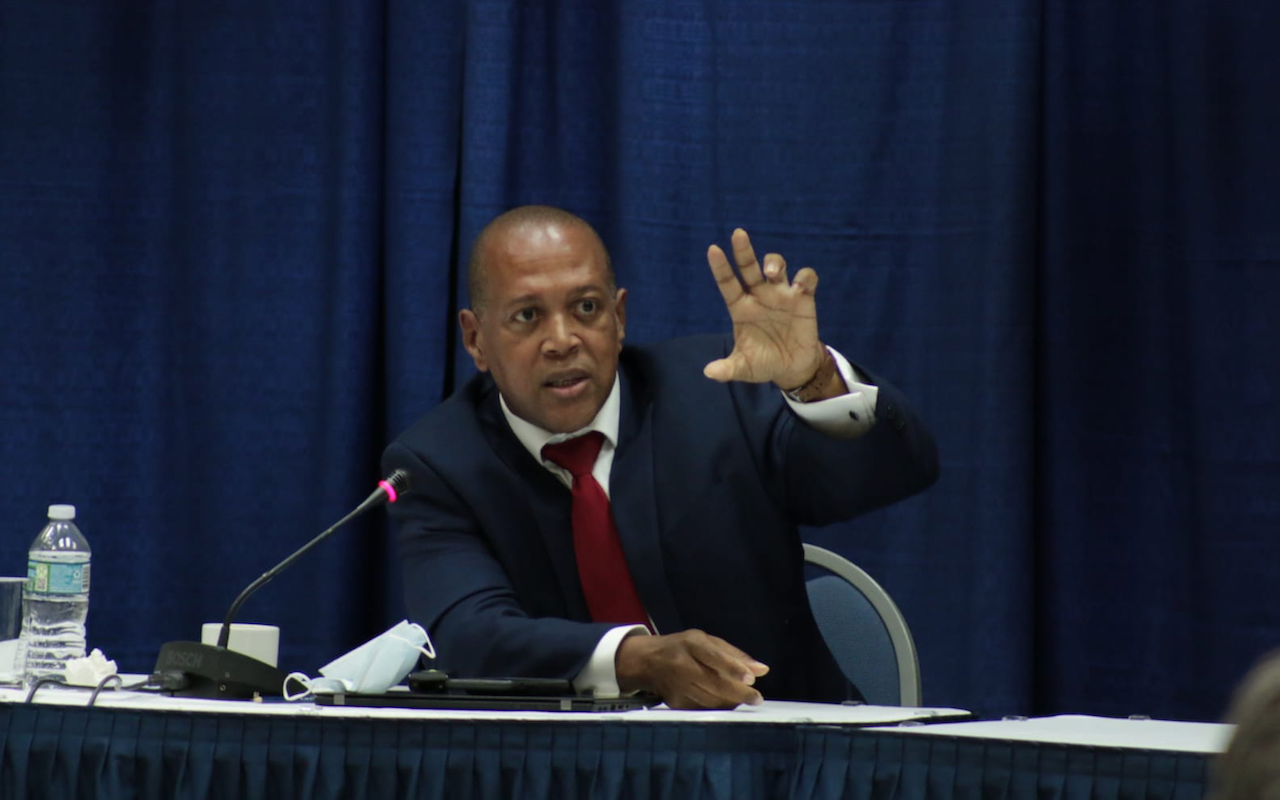

Senior Economic Advisor to the Barbados Government Dr Kevin Greenidge believes Barbados entered an International Monetary Fund (IMF) programme at least five years after it should have.

While speaking during Monday’s Down to Brass Tacks call-in programme on VOB, Greenidge said that from as early as 2012, many individuals within the financial and economic spheres felt the island was in desperate need of IMF assistance, given the challenges experienced due to the 2008 financial crisis.

“Around 2012-2013, the expectation was that Barbados would come to the IMF soon, because all the indicators suggested that you would need some assistance to deal with what was going on. At that time, we had the 2008 global financial crisis, and the government of the day responded and tried to deal with it, and the crisis continued and the pressure intensified,” he said.

“We have learned since, that you can’t respond by ballooning out your expenditure side of the fiscal, you can’t respond by increasing things that would become a permanent fixture on your budget.

“What grows the economy is investment…. By that time in 2013, the capital investment had almost halved and the government was investing much less, but its transfers for SOEs [state-owned enterprises] for salaries and for debt payment had increased three or four times, so that was an indication that help was needed and the economy was not growing. That would have been the time to come [to the IMF],” explained the senior economist who is on secondment to government from the Washington-headquartered financial institution.

It was not until October 1, 2018, shortly after coming to office, that the Mia Mottley administration entered a four-year arrangement with the IMF under the Extended Fund Facility (EFF). The EFF supported a homegrown Barbados Economic Recovery and Transformation (BERT) programme and the Government received total disbursements of $870 million.

Greenidge noted that with the island entering an IMF programme later than it needed to, the adjustments required to pull the island out of its economic slump had to be significant in nature, which inevitably led to many Barbadians feeling the financial pinch after 2018.

“This meant that a lot of the adjustments that we had to do became extremely critical and had to be done upfront – dealing with the sewage system, the transport system – because if Government is not investing, these things deteriorate,” Greenidge said.

Dr Justin Robinson, a Professor of Finance and Dean of the Faculty of Social Sciences at the University of the West Indies Cave Hill Campus, who was also on Monday’s programme, shared similar sentiments as to the late timing with the programme.

He said that though many citizens may believe the IMF has caused them economic hardship, the programme was necessary medicine for the island’s aliments at the time.

“IMF programmes are not designed to give pleasure, it’s not a holiday. I think of the IMF within the financial system as the place you go where you are sick enough and you need a certain type of treatment. So, to me, it’s not whether the IMF is good or bad per se. When you are in the state that Barbados was in, then the IMF was the appropriate place to go for the treatment,” Professor Robinson said.

Meantime, Greenidge indicated that during the life of the EFF, which ends on September 30, the IMF did not have any control over what the money could be used for.

“That kind of programme would have evolved when we hit COVID…. For the Government, the priority was rebuilding the infrastructure that had deteriorated prior to the programme, and helping to build out our social protection networks,” he said.

“If persons would go back and cast their minds to before the BERT programme, people would tell you that you could not get a bus, very few buses were working, and about 75 per cent of the buses were off the road for repairs, missing parts, things like that. So, getting buses was a critical part of the programme. Re-doing the sanitation fleet was a critical part of the programme, and the priorities of the Government was supported by this kind of funding.”

The senior advisor said that while some Barbadians remained against borrowing from the IMF, because of a perceived risk when it comes to the country paying back the loan, the loans approved and disbursed by the IMF were structured in such a way under the BERT programme, to be as seamless and fair as possible, while maintaining a sustainable debt-to-GDP ratio.

“We have a framework that extends out in terms of our borrowing and repayment. We do an assessment of every loan, how it impacts the overall loan portfolio and how we will repay – that goes out to 2040, years from now. What we do is make sure that any loan does not compromise our ability to repay.

“That debt sustainability analysis is done by the Government of Barbados, it is also done by the IMF, and we share it with the rating agencies and all of the relevant banks, so people have no doubt in our ability to repay.”

shamarblunt@barbadostoday.bb