The top leadership of Pine Hill Dairy (PHD) is hailing the dairy and juice manufacturer’s balance sheet as “trending in a relatively strong position”. This, despite a significant loss reported in the first quarter.

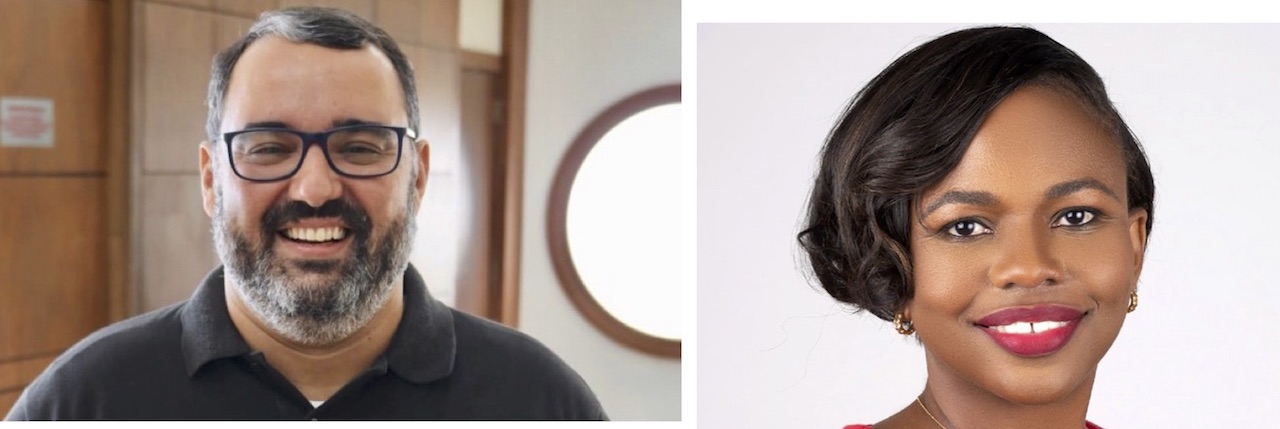

Commenting on the unaudited summary consolidated financial statements for the period ending March 31, chairman of Banks Holdings Group – the parent company of Barbados Dairy Industries Limited (BDIL) which is trading as PHD – Caio Miranda, and country manager Shafia London expressed optimism, even with the total comprehensive income loss reported.

They argued that the performance in the first quarter showcased the efforts of the Banks Holdings Group to deliver revenue growth when compared to 2022.

PHD recorded revenue sales for the review period of $13.13 million, up from the $12.13 million recorded for the same period in 2022.

According to Miranda and London: “Barbados Dairy Industries Limited has not been immune to significant volatility in the market over the last few years, stemming from supply chain unavailability and inflation.

“BDIL continues to absorb most of these impacts, resulting in an upward trend of our COGS [cost of goods sold]-to-revenue ratio which closed at 96 per cent for the last quarter compared to 84.5 per cent for the comparison period.”

In response to the challenges faced by the subsidiary, the country manager and chairman said management was reviewing and implementing several initiatives to “quickly reverse this trend”.

These actions include what they described as “cost efficiencies and adjustments” in the price to trade.

The senior officials conceded that despite the increased revenue generated in the quarter, it was not enough to offset operational costs, thus leading to a net loss for the period.

In their assessment, London and Miranda described the company’s balance sheet as trending “in a relatively strong position”.

They noted also that despite a reduction against the comparative period of 2022, the working capital remained “in a solid financial situation, showing that the short-term financial health of the organisation is stable”. (IMC1)