Straughn: No real double taxation on pensions

By Marlon Madden

Minister in the Ministry of Finance Ryan Straughn has rejected calls for the Government to review its tax policy on private pension schemes and remove the double taxation.

However, he has given the thumbs up to the idea of allowing managers of pension funds to have access to greater sums of US currency to invest more overseas.

“I do not accept that there is double taxation in the way that people are suggesting that it is,” he said on Wednesday as he responded to criticism that the Government was hitting retired persons twice by taxing their pensions, given that those individuals would have paid tax on their earnings while in the workforce.

The economist maintained that the lowering of the individual income tax and corporation tax rates had sufficiently compensated for the removal of the tax deduction on pensions about eight years ago.

“The concept of double taxation today is not relevant in the same way that it was when the tax rates were at 33 per cent [for individuals] and 40 per cent [for corporations]. So I am saying that the disposable income today for any person who was making contributions into their pension funds today, relative to 25 to 30 years ago, is not the same,” he insisted.

“So because your tax rates have declined, your disposable income has increased. Therefore, what you do with that disposable income is entirely up to you. We want to see people plan for their retirement. Also, let me remind you that for pensioners themselves, there is a different tax allowance that is proposed to increase to $45 000 next year. So I do not accept that there is double taxation in the way that people are saying that it is, especially given the current tax posture of the government.”

Calls from sections of the private sector for the Government to stop taxing pensions have been renewed in light of the planned increase of the pensionable age to 67.5 years in 2028 and then to 68 years in 2034. It is also proposed that the number of contributions required for individuals to be eligible for a full pension be increased from 500 weeks to 750 weeks – from 10 to 15 years, approximately.

Also proposed is an adjustment to the age for individuals to qualify for an early pension, from 60 to 61 years in 2025, then 62 years in 2028, and 63 years in 2031.

Minister Straughn said that given the reduced individual income tax rates, individuals should be in a better position to invest in registered retirement savings plans (RRSPs).

From 2015, individuals with RRSPs were no longer able to claim a tax credit of up to $10 000 on their plans when filing their annual income tax return.

When the Mia Mottley-led administration came to office in 2018, the Government announced that effective January 2019, the corporation tax rate would be lowered from 40 per cent to between 1 and 5.5 per cent, based on a scale of earnings.

Effective January 2020, the basic income tax rate was kept at 12.5 per cent on the first $50 000 of taxable income and lowered from 33.5 per cent to 28.5 per cent on taxable income above $50 000.

“So while I understand that persons may wish to have, within the context of the private sector, a perspective that there should be a return of the allowance, the reality is that the tax situation has changed since those allowances were introduced almost 30 years ago,” Straughn said.

“Therefore, as we look at it now, people actually have now more disposable income that is not taxed that they can invest in RRSPs and, certainly, corporations who are faced with less corporate income tax then can, based on their contribution to the employees’ contributions, have enough space to be able to do that. So the concept of double taxation as I see it, is not relevant in the same way as it was 25 years ago.”

On Tuesday evening, the NIS announced that it has been given approval from the Central Bank to acquire some US$40 million (BDS$80 million) to invest overseas.

Asked if the Government would consider giving pension funds greater leeway to engage in more US currency investments in light of the Central Bank’s approval for the NIS, Straughn answered in the affirmative, noting that the island’s international reserves were healthy and could handle it.

Several years ago, pension funds were able to access up to US$250 000 (BDS$500 000) in foreign exchange every quarter under a tiered system, but in more recent years these funds have been limited in the amount of foreign exchange they are able to receive from the Central Bank to invest overseas and they are required to go through a special approval process.

“We certainly have a healthy amount of reserves available today and, therefore, we are continuing to encourage pension funds to make sure that the investment outside of Barbados is also done to also be able to diversify their portfolio.

“There is still a cap now, but we are reviewing that consistently to make sure that we can do more because at the end of it, pension funds are long-term investors and therefore they need long-term assets to be able to invest in,” said Straughn who suggested that government securities should also become attractive again for everyone, including pension funds.

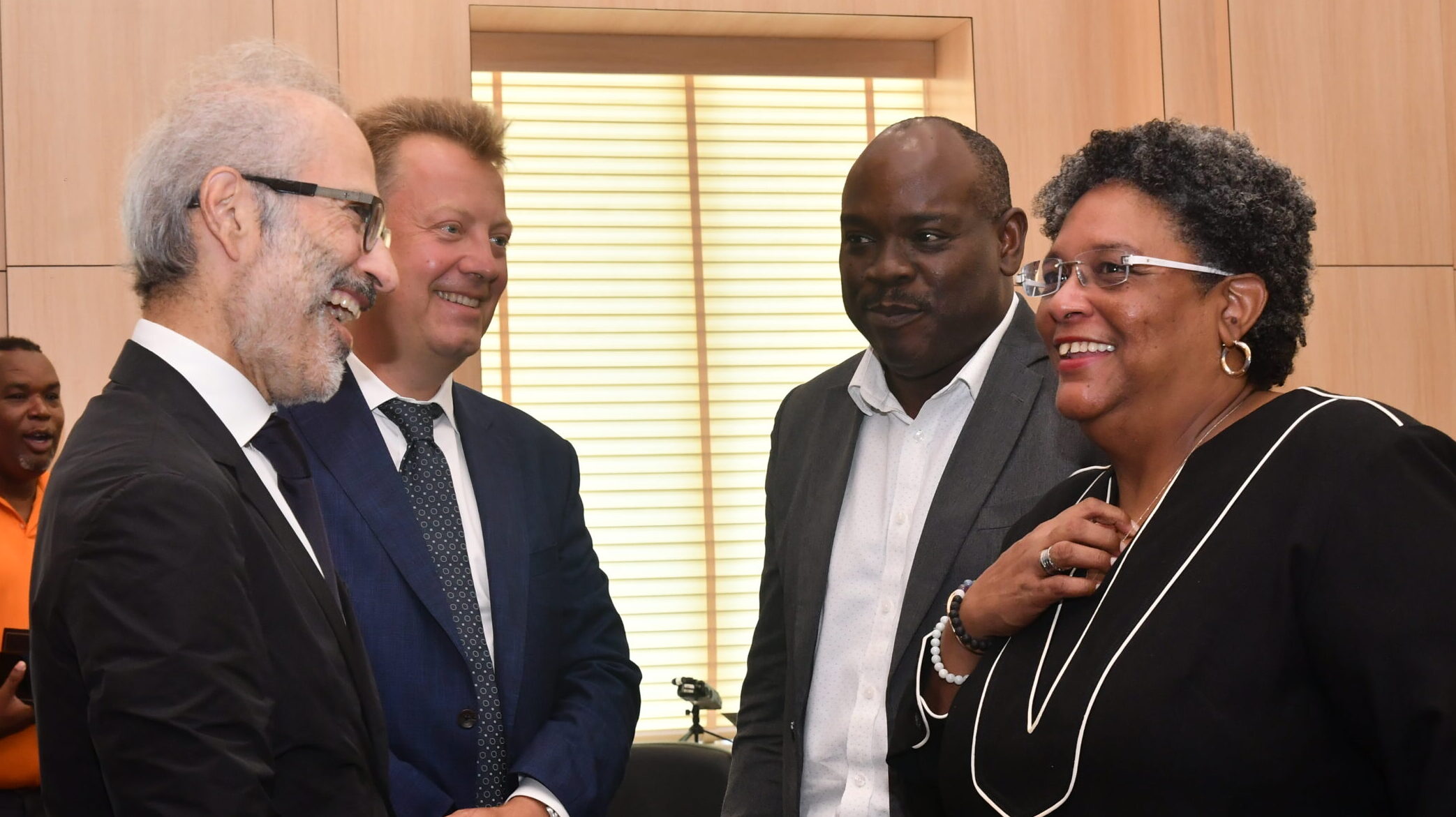

He was speaking with reporters following the renaming of the old Mutual Building in Bridgetown that now houses the University of the West Indies (UWI) City Campus.

The building, which now bears the name The Dodridge Miller Economic Justice Building, is named after the former President and Chief Executive Officer of Sagicor Financial Company Limited.